The Black Swan Theory. Risk Management for Black Swan Events

- Stefan Sager

- Aug 16

- 7 min read

Updated: Oct 16

For centuries, the phrase a Black Swan was a common expression for an impossibility––a metaphor for a belief held with absolute certainty. This was based on what seemed like unassailable empirical evidence: every swan ever observed by Europeans had been white. Then, in 1697, Dutch explorers witnessed black swans in Australia for the first time. In an instant, a single observation invalidated a belief system built on millennia of confirmatory data.

This historical discovery is the foundation for one of the most important mental models for understanding our modern, unpredictable world: The Black Swan Theory.

It is not merely an interesting anecdote; it is a profound framework that challenges our deep-seated faith in forecasting and provides a new, more robust lens for managing risk in a world where history does not crawl; it jumps.

This article will explore the theory's core principles and provide a practical toolkit for applying them, shifting your strategic focus from the futile act of prediction to the pragmatic act of preparation.

I. The Core Idea

An Unpredictable, High-Impact Event

Popularised by the essayist and risk analyst Nassim Nicholas Taleb, a Black Swan is a rare, unpredictable, and high-impact event that, in hindsight, appears to have been inevitable. Taleb, drawing from his experience as a quantitative trader, formally defines a Black Swan by three inseparable attributes that set it apart from mere surprises.

It is an outlier

The event lies so far outside the realm of regular expectations that nothing in the past can convincingly point to its possibility. It exists in the realm of "unknown unknowns," rendering conventional forecasting models, which are built on historical data, completely blind to its existence.

It carries an extreme impact

The event is not a minor anomaly; it is a paradigm-shifting occurrence that can reshape industries, economies, or the course of history. The impact can be negative, like the 2008 financial crisis, or profoundly positive, like the invention of the personal computer, which was equally unpredictable and transformative.

It is rationalised in hindsight

Despite its initial unpredictability, human nature compels us to create a coherent narrative after the fact that makes the event seem explainable and predictable. This cognitive trap, known as hindsight bias, is the most dangerous aspect of the phenomenon, as it creates the illusion that if we just try harder or build better models next time, we can predict the next crisis. This reinforces a misplaced faith in prediction and prevents us from learning the true lesson: for certain classes of events, prediction is impossible.

II. The Practical Toolkit.

A Framework for Risk Management for Black Swan Events

The Black Swan theory is not a philosophy of despair at our inability to forecast; it is a practical call to action. The strategic goal is to shift your mindset and your systems away from prediction and toward preparation and resilience.

Business Health. Build Robustness & Redundancy.

In the modern business environment, efficiency is often king. Just-in-time supply chains and maximised leverage are praised for cutting costs. However, this over-optimisation creates profound fragility. A system perfected for one specific set of conditions is acutely vulnerable to any unexpected disruption. The Black Swan-informed strategy involves intentionally building in "inefficiencies" that serve as buffers. This includes maintaining substantial cash reserves instead of being fully leveraged, diversifying supply chains across multiple geographies to avoid single points of failure, and investing in redundant IT infrastructure. These measures represent a tangible cost in stable times but provide invaluable, business-saving resilience during a crisis. The goal is not just to survive shocks, but to be in a position to thrive afterward, gaining market share from less prepared competitors. Your competitors might win the battle, but you will win the war.

Financial Health. Adopt a Barbell Strategy.

Conventional investment theory, built on bell-curve statistics, systematically underestimates extreme market events. To counter this, Taleb proposes a Barbell Strategy: risk management for Black Swan Events. This involves allocating the vast majority of your capital (e.g., 85-90%) to extremely safe, risk-free assets like cash or Treasury bills. This portion of the portfolio is protected from negative Black Swans. The small remaining portion (10-15%) is then allocated to highly speculative, high-risk/high-reward bets, such as angel investing in startups. This strategy is designed to be antifragile: it severely limits your downside from negative events while giving you exposure to the potentially unlimited upside of positive Black Swans, like investing in the next internet-level technology.

Personal Health. Create a Margin of Safety.

The illusion of a stable, predictable life path such as education, career, retirement, leaves individuals fragile to shocks like a sudden job loss or a serious health diagnosis. The solution is to build a Margin of Safety into every critical area of life. Financially, this means a robust emergency fund with 6-12 months of living expenses. Professionally, it means cultivating a diverse skill set and a broad network, making you less dependent on a single employer. In your daily life, it means avoiding a schedule so tightly packed that a single delay causes the entire system to collapse. This isn't pessimism; it's a pragmatic acknowledgment of uncertainty that provides immense psychological and practical freedom.

Physical Health. Focus on Antifragility.

The human body is a complex system that benefits from varied stressors. An antifragile approach to health involves a regimen that prepares the body for a wide range of demands, not just one. A fitness plan that combines high-intensity strength training (an acute stressor that builds muscle), low-intensity cardiovascular work (for endurance), and varied mobility exercises (for flexibility) is far more resilient than one that consists solely of running the same five-mile route every day. The latter optimizes for one specific task, while the former builds a broad, adaptable physical capacity that is more robust against unexpected injuries or health challenges.

Social Health. Build Decentralised Communities.

We often assume our social structures are stable. Black Swan events, from natural disasters to geopolitical shifts, reveal their fragility. Resilient social health is built by investing in deep, authentic relationships and strong local communities that are not wholly dependent on fragile, centralised institutions. A crisis acts as a stress test for relationships; the connections that survive and strengthen are the ones built on a foundation of genuine mutual support, not just fair-weather convenience.

III. The Everyday Analogy.

The Turkey Problem

Nassim Taleb's most powerful metaphor for the Black Swan problem is that of the Thanksgiving turkey. A turkey is brought to a farm and is fed every single day for 1,000 days by a farmer. From the turkey's perspective, the evidence is overwhelming. Each feeding reinforces its belief that the farmer is a benevolent friend and that this is a universal rule of life. Its confidence in the stability of its environment grows with each passing day.

On the afternoon of the 1,001st day, its feeling of safety is at its absolute maximum. The next day, the farmer arrives not with food, but with an axe, forcing the turkey to undergo a sudden and fatal revision of its beliefs.

This story illustrates the problem of induction, the flaw in using a series of past observations to forecast the future. The turkey's confidence was highest precisely when its risk was at its maximum.

It tragically demonstrates that an absence of evidence (of harm) is not evidence of absence (of risk).

We are all susceptible to being the turkey whenever we extrapolate from a stable past to assume a stable future. The strategic goal is to structure our lives to avoid being the turkey.

IV. The Deeper Dive. The Flaw in Our Forecasts

The Black Swan Theory is a direct assault on our deeply flawed approach to prediction. Taleb argues that history is shaped by a series of unpredictable shocks. He identifies two distinct domains:

Mediocristan

The realm of the average and the predictable, like human height or weight. In this domain, outliers are rare and have a negligible effect on the total. The statistical bell curve is a useful map for this territory.

Extremistan

The realm of the extreme and the scalable, like wealth or financial markets. In this domain, a single observation can radically impact the total, and outliers are the primary drivers of the system.

The critical error, which Taleb calls the Great Intellectual Fraud, is applying the statistical tools of Mediocristan to the problems of Extremistan. Financial risk models that rely on the bell curve are blind to the "fat tails" of reality, which is precisely where Black Swans reside.

V. The Advanced Context. Beyond the Black Swan

The theory connects with other models to form a coherent framework for navigating uncertainty.

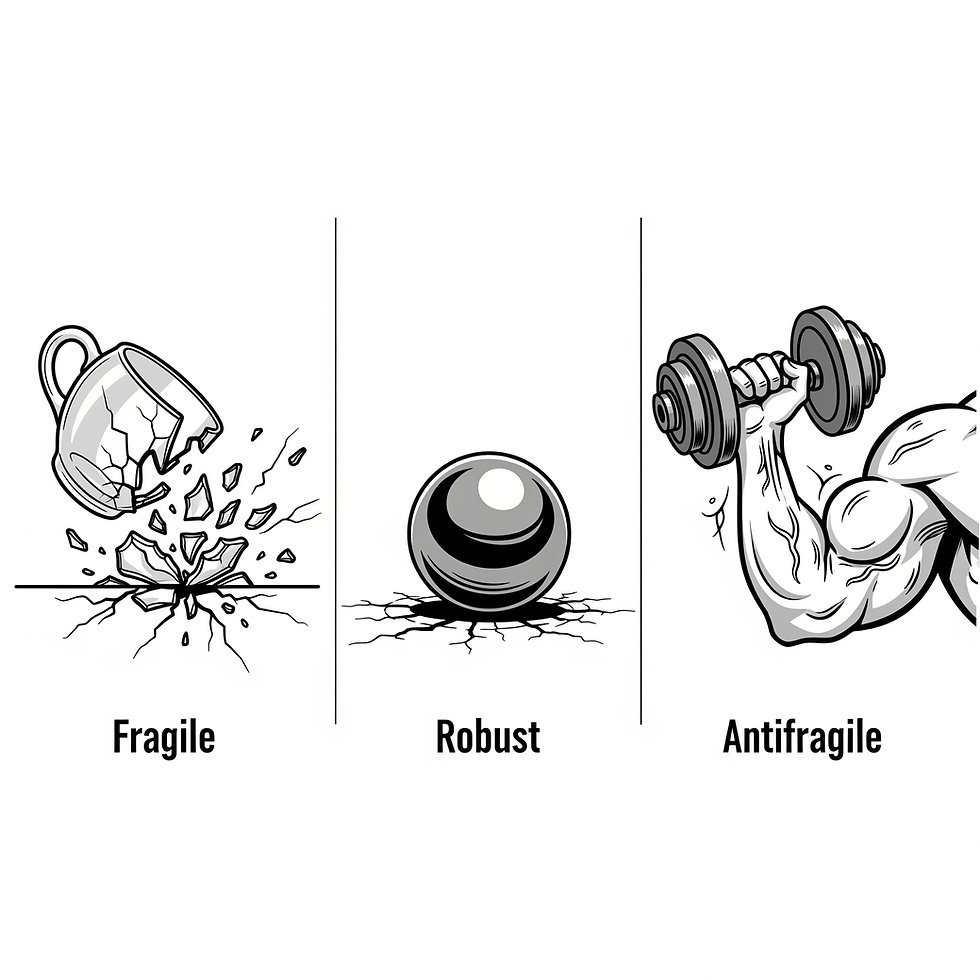

This is Taleb's proposed strategic response to a Black Swan world. A robust system survives shocks; an antifragile system actually gains from them. A market crash bankrupts fragile companies, but it creates immense opportunities for robust, cash-rich companies to gain market share. Antifragility is the offensive strategy for a world of inevitable shocks.

This concept is the philosophical foundation of the problem. Our models of reality (the map) are not reality itself (the territory). Vulnerability to Black Swans arises when we forget this, mistaking our elegant, simplified financial models for the messy, unpredictable real world.

It is also crucial to understand that Black Swans are not exclusively negative events. The invention of the internet and the discovery of penicillin were positive Black Swans that reshaped the world for the better.

The goal is to build systems that are protected from negative Black Swans while remaining open to the upside of positive ones.

By embracing the reality of radical uncertainty, we can move from a state of fragility and surprise to one of robustness, resilience, and even antifragility.

Ready for Your Next Model?

This article was a deep dive into one powerful concept. Our interactive Mental Model Advisor can help you find the perfect framework for your next challenge.

We appreciate you subscribing (below) it allows us to:

Publish new Mental Models every week.

Remain 100% independent and ad-free.

Grow our library of resources for the community.

All resources can be found here

Comments